An Experienced Investor Shares the Best Way to Start Investing

in Stocks, Options, Dividends and Cryptocurrency

The best way to start investing in stocks, options, dividends and cryptocurrency is with small regular investments over time. Tiny incremental investments is how I started investing decades ago when I was a poor and indebted student. This early investing has led to great success. I was since able to retire early, and I have advanced onward and upwards into more advanced investing and trading techniques. Allow me to share some tips on how you can get started today safely building a more secure future.

The best way to start investing in stocks, options, dividends and cryptocurrencies is with small regular investments over time. Following are the best platforms I'm using for each.

The best way to start investing in stocks, options, dividends and cryptocurrencies is with small regular investments over time. Following are the best platforms I'm using for each.Dividend investing is a good starter stepping stone on the path to these more advanced techniques later on. I've been investing in portfolios of high paying dividend stocks and trading stocks and stock options for over 25 years. I started VERY small and grew my portfolios and knowledge over time and it's made a huge difference in enabling me to live life on my own terms.

Investing has helped me pay for college, helped me pay for a nice lake front home free and clear, helped me grow other passive income businesses, helped me grow nice retirement accounts....AND best of all even helped me retire early from my much hated corporate job at the age of 38. I now have the time and energy to focus full-time on building my own businesses and investing more.

"If you never take some calculated risks in your life, your life will be less than it could be"

Whether you are young or old, I highly recommend you get started by dipping your toe into the water of hands-free "set it, and forget it" small amount investing today. I'll share some of what I've learned. You can start with baby steps, like I did decades ago, even if you only have spare change.

"Everything's a cinch if you take it inch by inch"

You won't miss the small amounts automatically invested weekly or monthly. And as your nest egg and dividend income grows, you will get more interested and want to learn even more about the wide diversity of other ways you can safely and more wisely make money in the markets.

Taking small calculated risks will likely increase your freedom and options to do what you want later on down the road. And if anyone is thinking, "no way, I have debt, too little income, or I have zero money I can afford to invest with", allow me to enlighten you on how wrong you are and why you really can start with little to no knowledge about investing.

You can start growing a professionally managed growth and dividend stock portfolio right now even with as little as your spare change. Here is one method I and hundreds of thousands of youngsters are using to grow emergency savings and extra retirement nest eggs safely and completely painlessly using Acorns automatic spare change investing into professionally managed stock and ETF portfolios (follow my referral link to get some FREE MONEY when you get started today):

https://www.acorns.com/invite/8NGP98

I started buying my first shares of stock right out of high school using what was at the time called "DRIPs" or "Dividend Reinvestment Plans". They allowed anyone to buy individual company shares a little at a time and have the dividends automatically reinvested into more shares. Dividend reinvestment is another way to get compounding growth over time with MUCH better potential returns and flexibility as compared to the current super low paying savings accounts or archaic Certificates of Deposit.

Now all discount brokers do dividend reinvestment in house automatically, with no commissions. And many are even beginning to allow purchase of fractional shares directly, so you don't have to come up with the huge cost for a whole share of high dollar share price stocks like Amazon, Google, or Tesla. I use a platform called Robin Hood, which is THE most popular phenomenal investing platform for zero cost investments in everything from fractional stock shares, dividends, options and even cryptocurrencies (follow my referral link for a 100% CHANCE TO GET FREE STOCK once you set up your account. And find out how to earn even more free stock shares):

https://join.robinhood.com/marcs1276

My first job allowed company stock purchase and company % match on whatever I put in, up to a limit each year. They deducted my desired investment amount from my paycheck automatically. PLUS they matched my investment with a percentage of free money on top to buy more shares.

Dividends from my growing stock ownership account was automatically invested back into yet more shares which earned yet more dividends, and so on and so forth with ever-compounding growth. And like a 401K retirement plan, it was pretty painless, I didn't even miss the small deductions from my paycheck and my money grew slowly but surely with each investment I made, plus the company's growth and as they upped the dividends and split the stock.

These types of "slow and steady wins the race" incremental investments over time is a good way for young people to begin investing. This results in what's called "dollar cost averaging" whereby you end up purchasing more shares when stock price is lower, and less shares at higher stock prices. So averaged out over many cycles of bull markets and bear markets, purchases made regularly the entire time will have a lower average cost per share than if you had tried to time the market and often got it wrong. Dollar Cost Averaging lowers risk and stress, enabling more wise growth of portfolios of stock shares without having to fret over each correction or gyration in the markets.

Over the last decade, I have advanced from trading just stock shares, to also daily trading stock options. Along the lines of dividend investing, with options you can effectively create your own additional dividends on stock shares you may already own (or not) by selling Call or Put option contracts against those stock shares, and taking advantage of their built-in time decay (theta) or fluctuations with implied volatility in the markets.

I currently use TdAmeritrade for daily high volume stock options trading. Commissions are zero and their highly advanced Think Or Swim trading platform is the best available. If anyone wishes to open an account or check it out, consider contacting me through this website and I can refer your email address so you and I get a $50 bonus when you fund your new account with at least $3000. Win/win.

Another thing to keep in mind. You can also buy option contracts as proxies to speculate on a rise or fall in markets or individual stocks, but with defined and limited risk and much less capital compared to owning stock shares outright.

You can also use stock options to help insure against losses on existing stock holdings or to help protect entire portfolios from market volatility. But options trading, like crytocurrency investing, can involve more risk and is a more advanced and hands-on investing strategy. So I would not recommend stock options and cryptocurrencies if you are a beginner.

If anyone ever has any questions or needs further advice on the best way to start investing in stocks, options, dividends and cryptocurrency, please feel free to contact me via my contact form.

Recent Frugal Living Articles

-

Hundreds of Easy Homemade Household Products Recipes for Frugal Living

Extensive list of simple home-made, non-toxic, and more effective product recipes you can quickly make yourself. Safer cheaper than toxic store-bought items -

Almond Oil Uses, Sources, Costs, Household Tips & Remedies

Guide to Almond oil, sources, current price per volume, ways to save money on almond oil, how to make it at home, and some common household remedy recipes -

40 Cheap Beef Cuts for Frugal Meals and Thrifty Beef Dishes

An extensive guide to the best cheap beef cuts with often more flavor and as much nutrients as prime loin cuts, yet without the tenderloin prices -

Hundreds of Senior Discounts for Frugal Retirees and Citizens Age 50 or Older

Extensive lists of Senior Discounts for hotels, cruises, restaurants, stores, travel deals, and much more -

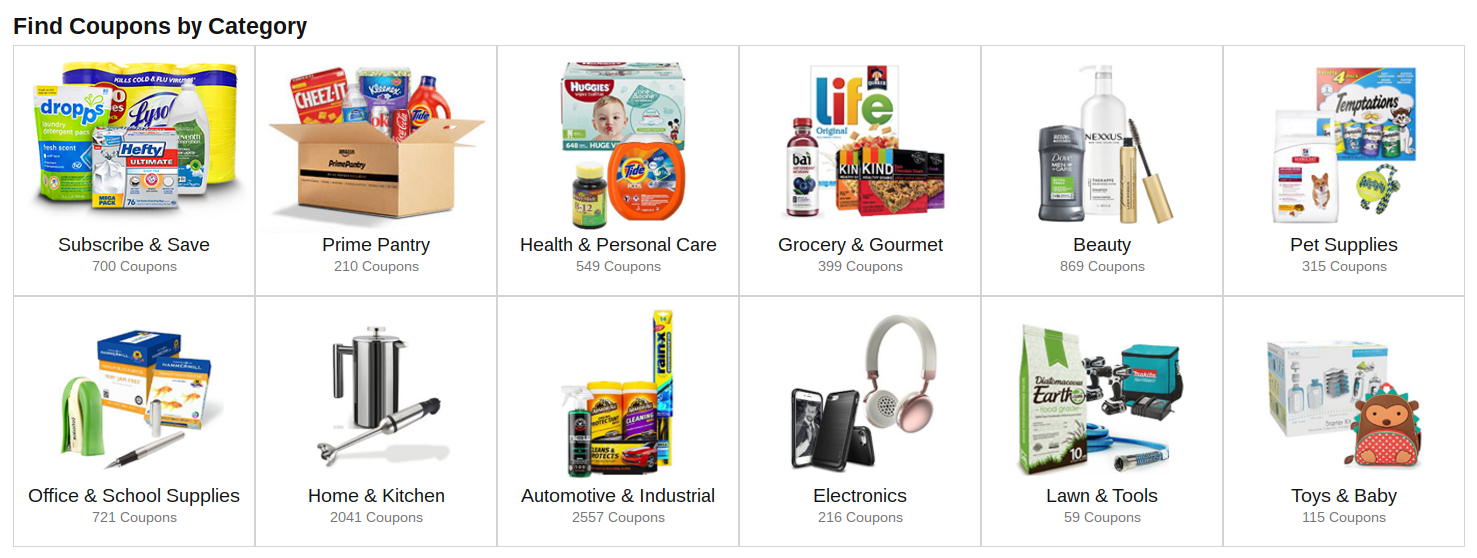

New Amazon Coupon Codes: Uncensored & Avant Garde Tricks of the Trade

Become a Fiscal Zen Master of finding & maximizing Amazon Coupon Codes and deals. Learn from the Yoda of Online Gorilla Shopping Tactics & become a Thrifty Nemesis to Bean Counters & Billionaires